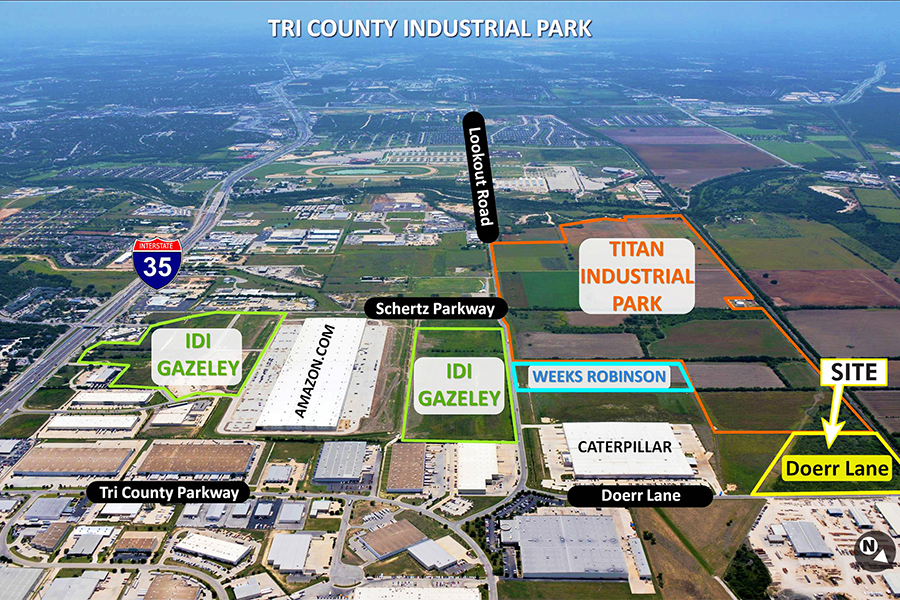

Doerr Lane Industrial Park will feature 213,864 square feet of contemporary industrial space in a cross-dock configuration. The 32′ clear facility has been designed to accommodate 58’9″ x 52′ column spacing with 60′ x 52′ expanded staging bays and an ESFR sprinkler system. Distribution efficiencies are supported with the building’s 54 dock high loading doors and two ramp-served doors. Sizable truck courts with on-site trailer parking and storage will also be incorporated together with generous vehicle parking.

“We are pleased to announce this premier speculative development in Schertz, Texas,” remarked Stringer. “With the assistance of my colleague, Justin Scott, Development Manager for Conor Commercial, this development opportunity was identified due to the area’s positive market fundamentals in this northeast submarket of San Antonio. With strong absorption, low vacancy rates, limited supply of large contiguous space and increasing user demand in Schertz, we are confident that this Class A speculative facility will meet the requirements of a variety of industrial users who will benefit from contemporary warehouse/distribution space coupled with this strategic location.”

Terry S. Warth, SIOR, of the San Antonio office of CBRE represented the seller of the land parcel while Rob Burlingame, CCIM, and Josh Aguilar, both from CBRE’s San Antonio office, represented Conor Commercial Real Estate in the acquisition of the property. Warth, Burlingame and Aguilar have also been selected as exclusive leasing agents for the development.

For additional information about Doerr Lane Industrial Park, please contact Warth (210.507.1133 / terry.warth@cbre.com), Burlingame (210.507.1123 / rob.burlingame@cbre.com) or Aguilar (210.253.6049 / joshua.aguilar@cbre.com) or visit the property’s web site at www.doerrlaneindustrialpark.com.